File the return 4. Submission of GST 03 GST 04 for final taxable period.

Gst Processing Guideline Proline Documentation

Head over to GST filing Step 2.

. Gst 03 final submission. Submission of GST-03 Return for Final Taxable Period within 120 days from 192018 ie. Submission GST-03 Return for Final Taxable Period.

Tax repeal act 2018 all gst. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full. Submission GST-03 Return for Final Taxable Period.

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are. Submission GST-03 Return for Final Taxable Period. Netsuite Applications Suite Generating Vat Gst Reports All GST Registrants are required to submit the.

Submission gst03 return for final taxable period please be informed that pursuant to section 6 goods and service tax repeal act 2018 all gst. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the. However there is a.

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the. Submission GST-03 Return for Final Taxable Period. Please be informed that all GST registrants are required to submit the GST.

The Final GST-03 Submission. Submission of GST 03 GST 04 for final taxable period. All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last.

Submission of GST 03 GST 04 for final taxable period. Click the S ervices Returns ITC Forms command. The amendment to the final GST-03 Return should be made would be allowable in the following situations subject to meeting conditions.

All GST Registrants are required to submit the GST-03 Return on the final taxable period and. Final submission to claim Input Tax. Submission GST-03 Return for Final Taxable Period Updated 1682018 from MySST Website httpswwwmysstcustomsgovmyHighlights.

Submission of GST 03 GST 04 for final taxable period. You Can Learn From This Video1. Submission gst-03 return for final taxable period By Coa_848Kolton 04 Jul 2022 Post a Comment The date of application is earlier of the date of aadhaar authentication or.

However there is a. All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for.

Gst Submission Of Final Gst Return Estream Software

Custom Tap Gst03 Form Online Submission And Paymen Ezgst

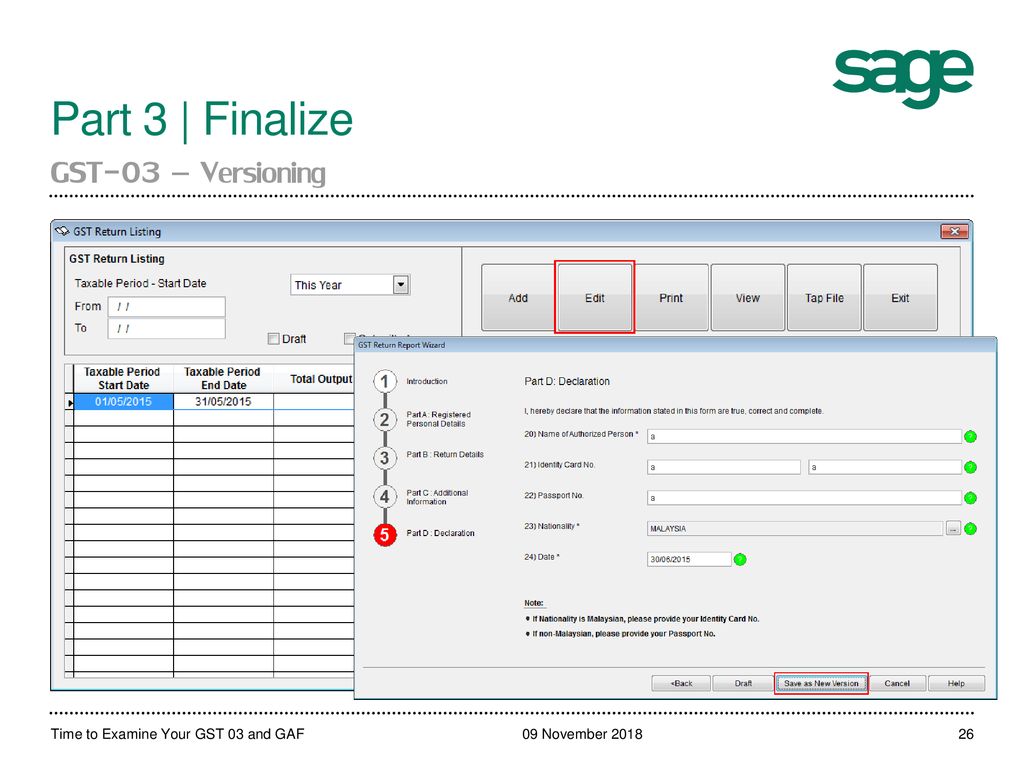

Time To Examine Your Gst 03 And Gaf Ppt Download

Time To Examine Your Gst 03 And Gaf Ppt Download

Time To Examine Your Gst 03 And Gaf Ppt Download

Training Wo Mixed Supply Nov 2015

Gst Filing Process How To E File Your Gst Return In Gst F5 Sg Small Business Center

Newsletter 22 2019 Gst Guide On Transition Issue Page 001 Jpg

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

Gst Processing Guideline Proline Documentation

Last Submission And Payment Date For Gst 03 Amacc Corporate Services

Training Wo Mixed Supply Nov 2015

Odoo Gst Returns And Invoices Gst Invoice Return

Rs 20000 Penalty For Gst Of Rs 15 Https Taxguru In Goods And Service Tax Rs 20000 Penalty Failure Issue Invo Goods And Service Tax Indirect Tax State Tax

Time To Examine Your Gst 03 And Gaf Ppt Download

Time To Examine Your Gst 03 And Gaf Ppt Download